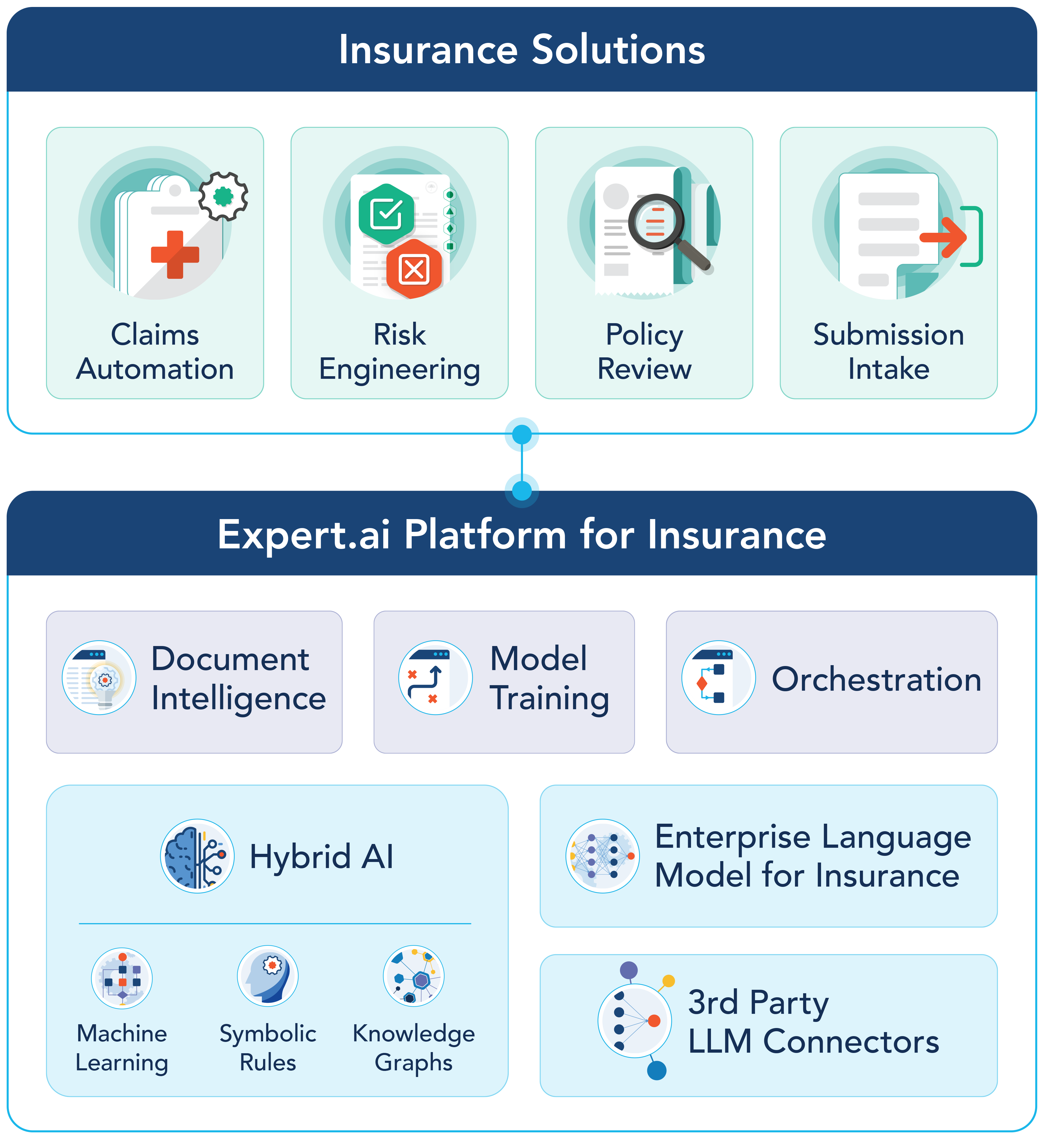

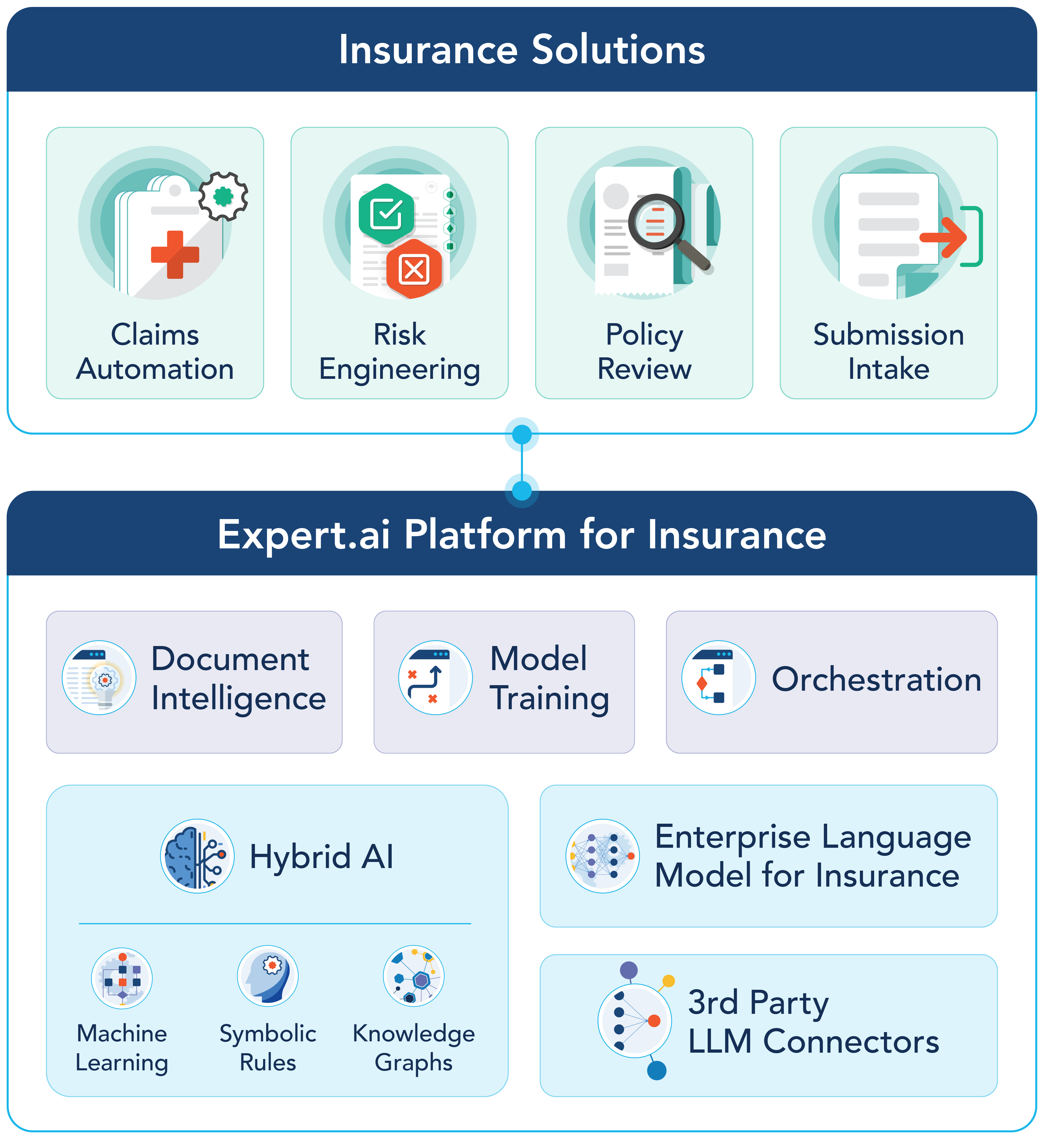

The expert.ai Platform for Insurance leverages enterprise insurance language models to improve insurers’ throughput and cost of operations for language-intensive workflows.

Expert.ai, the industry leader in AI-powered language solutions, today announced availability of the expert.ai Platform for Insurance. The expert.ai Platform for Insurance powers underwriting and claims solutions so that insurers can use natural language processing to eliminate documents from review cycles, extract needed data and prioritize which submission or claims need an expedited review or to be assigned to a senior adjuster based on complexity.

The expert.ai Platform for Insurance provides insurance teams with a way to automate the repetitive tasks associated with document reviews, extraction and assessments, freeing up time to focus on de-risking underwriting decisions, determining coverage and conducting preliminary claims investigations.

Key platform capabilities include:

– Out-of-the-box data extraction for common data fields

– Urgency, severity and intent routing for claims and submissions packages

– Extraction of key exposure factors, e.g., coverage exclusions, limitations, pre-existing conditions, etc.

– Accurate summarization for human review, e.g., pre-assignment of risk grades for human validation/evaluation from property risk engineers

– Data redaction for GDPR and PII (personally identifiable information), etc.

– Record type categorization and elimination of records from review cycles

– A customizable insurance-trained language model

From submissions and claims management through policy comparison and risk engineering, the expert.ai Platform for Insurance supports even the most intricate, complex and language-intensive uses cases.

The expert.ai Platform for Insurance supports:

Risk Engineers: automate scoring and unintended exposure, and identify policy inconsistencies for commercial building insurance

Metrics Impacted:

• Increase review capacity by 4X

• Automate risk scoring across 10 key categories

Underwriters: expedite policy review, comparison and routing based on underwriting triage guidelines, reducing leakage and risk exposure while ensuring coverage certainty and standardization

Metrics Impacted:

• Generate quotes 50{29fe85292aceb8cf4c6c5bf484e3bcf0e26120073821381a5855b08e43d3ac09} faster

• Save 2 hours on every policy review

• 24×7 coverage of submissions across channels

Claims Handlers: automatically extract critical content needed to accelerate claims processes and enable subject matter experts to focus on high-value tasks

Metrics Impacted:

• Reduce claim review times by 50+{29fe85292aceb8cf4c6c5bf484e3bcf0e26120073821381a5855b08e43d3ac09}

• Improve objectivity and accuracy

• Reduce document review times by 90{29fe85292aceb8cf4c6c5bf484e3bcf0e26120073821381a5855b08e43d3ac09}

“At expert.ai, we’ve deployed insurance solutions for Global 100 providers across the range of workflows from claims automation and risk engineering through policy reviews and submissions intake. Artificial intelligence, in fact, offers insurers tremendous potential to transform their operations, improve combined ratios and establish a lasting competitive advantage,” said Walt Mayo, expert.ai CEO. “The expert.ai Platform for Insurance provides AI-based NLP solutions to reduce time to production and scale in the future. From customizable language models to insurance use case trained models, we help insurers deliver real value across their organizations, with high levels of accuracy, significant time savings, tangible capacity gains and better customer engagement.”

Presenting the expert.ai Platform for Insurance

We will be showcasing the expert.ai Platform for Insurance during the Reuters “The Future of Insurance USA 2023” event in Chicago on June 27-28. Schedule a meeting with our AI expert at booth #14!