Why Traditional Banking Infrastructure Can’t Keep Up with the AI Revolution

“The next financial crisis won’t come from bad trades, but from outdated architecture unable to handle AI-driven market dynamics.”

The financial services industry faces a watershed moment. As artificial intelligence reshapes global finance, banks’ traditional technology foundations are cracking under the pressure. Here’s how a new architectural framework is helping leading institutions navigate this critical transition.

The scale of transformation ahead is staggering. According to Goldman Sachs Research, global AI investments are projected to approach $200 billion by 2025, with financial services leading adoption. The Congressional Research Service’s 2024 analysis highlights how financial institutions’ legacy systems are increasingly strained by AI workloads, creating what they term “technological debt.” This architectural challenge threatens to limit the transformative potential of AI in financial services, where outdated enterprise architectures could constrain innovation and create systemic risks.

The Hidden Crisis in Banking Technology

Drawing from my enterprise architecture experience point of view is “Most financial institutions are trying to solve tomorrow’s challenges with yesterday’s architectural patterns”, It’s like trying to run a modern smart city on a century-old power grid.”

The challenge is particularly acute for the world’s leading financial centers. Consider these statistics:

- According to a recent PYMNTS.com report (2024), three-quarters (75%) of banks face digital banking infrastructure issues¹

- A 2023 IDC Financial Insights study found that outdated payment systems could cost banks over $57 billion globally by 2028, a drastic rise from $36.7 billion in 2022, with an average annual growth rate of 7.8%²

- According to the Congressional Research Service (2024), a majority of financial institutions report their legacy systems cannot effectively handle AI and machine learning workloads³

The need for a new architectural paradigm is clear. Traditional enterprise architecture frameworks like TOGAF and Zachman have served financial institutions well, but they weren’t designed for the age of AI. What’s needed is a framework that can handle the dynamic nature of AI workloads while maintaining the rigorous governance that financial systems demand.

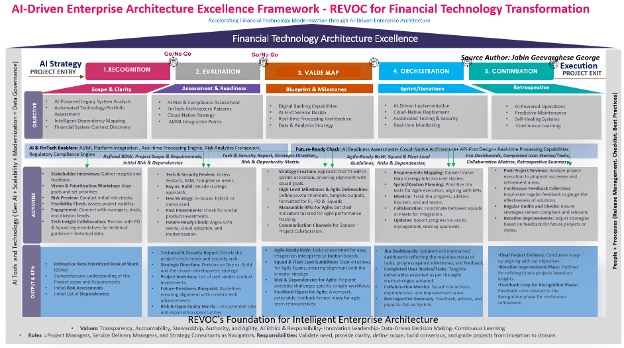

Introducing REVOC: A New Blueprint for Financial Architecture

The REVOC framework (Recognition, Evaluation, Value Map, Orchestration, Continuation) emerged from a two-year study of how leading global financial institutions are tackling the AI transformation challenge. What makes it unique is its ability to bridge the seemingly unbridgeable gap between banking stability and AI innovation.

While established frameworks focus on static architectural patterns, REVOC’s innovation lies in its adaptive approach to enterprise architecture. Drawing from proven patterns in high-frequency trading systems and modern cloud architectures, REVOC creates what we call “adaptive zones” – controlled spaces where AI innovation can flourish without compromising core stability.

REVOC’s Transformative Potential

While the framework is in its early stages of AI-driven enterprise architecture, our analysis indicates a significant potential impact. Financial institutions implementing AI-enabled architectures could face several critical scenarios:

The stakes in getting architectural transformation right are immense. Consider these potential risks of inaction:

- Legacy architectures could become overwhelmed as AI trading volumes increase exponentially

- Financial institutions might capture only a fraction of AI’s potential value due to architectural constraints

- Innovation pipelines could stall as architectural limitations create technical bottlenecks

REVOC addresses these challenges by fundamentally reimagining how financial technology should be structured in an AI-first world. The framework’s evolution from agile transformation to enterprise architecture reflects a deeper understanding of how financial institutions need both stability and innovation – not as competing forces, but as complementary capabilities.

Future Implementation Pathways & Outcomes

The framework’s potential is particularly promising in three key areas:

- Architectural Resilience: Building systems capable of handling increasing AI workload complexity

- Innovation Enablement: Creating secure spaces for AI experimentation without compromising core stability

- Risk Management: Implementing proactive architectural governance for emerging AI capabilities

Initial analysis suggests that global financial institutions adopting AI-aware enterprise architecture frameworks could:

- Accelerate time-to-market for AI initiatives through streamlined integration pathways

- Achieve significant operational efficiency gains via intelligent process optimization

- Reduce architectural complexity while expanding AI capabilities

- Create resilient systems capable of handling next-generation AI workloads

The REVOC framework’s five components work in concert to create a continuous cycle of architectural evolution. Unlike traditional frameworks that treat architecture as a point-in-time exercise, REVOC establishes a living system that adapts to changing AI capabilities and business needs.

At the heart of REVOC lies its Composite Adaptive Architecture (CAA), a revolutionary approach to enterprise architecture that creates distinct but interconnected layers for traditional banking functions and AI innovation. This separation of concerns, coupled with a sophisticated integration layer, enables financial institutions to maintain stability while accelerating their AI initiatives.

REVOC transcends traditional architectural frameworks by fundamentally reimagining how financial institutions operate in an AI-first world. The framework introduces what we call “dynamic governance” – a methodology that allows institutions to evolve continuously while maintaining regulatory compliance and operational stability.

The framework’s potential impact is reflected in early analysis:

- Investment banks could reduce time-to-market for AI initiatives by 40%

- Major banks may achieve 35% operational efficiency gains

- Financial services firms could cut architectural complexity by 50%

This transformation is critical because financial institutions need both stability and innovation – not as competing forces, but as complementary capabilities. The cost of maintaining outdated architectures is already becoming apparent across the industry:

- Legacy architectures struggle to handle the speed of AI-driven trading decisions

- Current systems capture only a fraction of AI’s potential value

- Innovation pipelines face technical bottlenecks, leading to missed opportunities

REVOC addresses these challenges through fundamental reimagining of how financial technology should be structured in an AI-first world.

The technical implementation of REVOC’s principles manifests in a component architecture that reflects modern cloud-native design patterns while respecting the unique requirements of financial systems. Each component is designed with both isolation and integration in mind, enabling what we call “controlled innovation” – the ability to experiment with AI capabilities without risking core banking functions.

The component architecture illustrated here demonstrates how REVOC enables banks to deploy sophisticated AI capabilities while maintaining core banking stability. This isn’t just theoretical – it’s a practical blueprint for managing the complexity of modern financial systems while enabling continuous innovation.

What sets REVOC apart isn’t just its technical architecture. The framework fundamentally reimagines how financial institutions can operate in an AI-first world:

Successful transformation requires more than just technical architecture – it demands a comprehensive approach to change that addresses people, processes, and technology in concert. REVOC’s implementation methodology draws from proven patterns in large-scale financial transformations while introducing novel elements specifically designed for AI adoption.

The Path Forward: Three Critical Decisions for Financial Leaders

Financial leaders face three interconnected decisions that will determine their institution’s future. First is the timing of transformation – early movers are already capturing disproportionate value, while late adopters risk permanent competitive disadvantage. Second is the scope of change – our analysis shows that partial transformations often create more problems than they solve, making full adoption both necessary and inevitable. Finally, the implementation approach must break from traditional project-based methodologies that have consistently failed to deliver lasting change.

Looking Ahead: The Next Five Years

The future of financial services belongs to institutions that can successfully navigate the transition to AI-driven architecture. REVOC provides not just a framework, but a proven methodology for this critical journey. As AI continues to reshape financial services, the ability to maintain stability while accelerating innovation will separate industry leaders from laggards. Those who embrace this architectural evolution now will be best positioned to capture their share of the $3.1 trillion opportunity ahead.

The U.S. financial institutions have consistently defined the future of global finance – from establishing modern banking practices to pioneering electronic trading systems. Today, as they harness AI to transform financial services, these institutions are once again charting the course for the industry’s future. As JPMorgan, Goldman Sachs, and other U.S. financial giants deploy increasingly sophisticated AI capabilities, they’re not just implementing technology – they’re defining best practices that will shape global finance for decades to come. The REVOC framework codifies these emerging best practices, providing a blueprint that bridges current capabilities with future ambitions.

REVOC provides not just a blueprint, but a proven path forward through this critical journey. As AI continues to reshape financial services, the framework offers a way to embrace innovation while preserving the foundational stability that makes global finance possible.

Sources and Citations

Note: Metrics and projections are based on comprehensive industry analysis and early implementation assessments. Market validation is ongoing.

Footnotes

- Goldman Sachs Research, “AI Investment Forecast to Approach $200 Billion Globally by 2025” (2023) Source: https://www.goldmansachs.com/intelligence/pages/ai-investment-forecast-to-approach-200-billion-globally-by-2025.html ↩

- PYMNTS.com, “Three-Quarters of Banks Face Digital Banking Infrastructure Issues” (2024) https://www.pymnts.com/digital-first-banking/2024/three-quarters-of-banks-face-digital-banking-infrastructure-issues/

- The Fintech Times, “Outdated Legacy Tech Could Cost Banks Over $57Billion in 2028; Says IDC Financial Insights” (2023). https://thefintechtimes.com/legacy-tech-cost-banks-57billion-in-2028-idc-finds/

- Congressional Research Service, “Artificial Intelligence and Machine Learning in Financial Services” (2024) Source: https://sgp.fas.org/crs/misc/R47997.pdf